STUDY HOW FAMILY WORKPLACES TACTICALLY BRANCH OUT AND ALIGN VALUES IN REALTY INVESTMENTS, SHAPING PROFILES FOR LASTING INFLUENCE AND SUSTAINABILITY.

Personnel Writer-Wells Laugesen

When purchasing real estate with purpose, family workplaces tactically shape their profiles. They diversify to handle threats and seize possibilities. Welcoming lasting and socially responsible investments is crucial for long-lasting value. Lining up worths with techniques makes an influence. Innovation plays a role with information analytics and smart remedies. Market awareness, adaptation, and danger monitoring are important. To navigate the real estate landscape effectively, household workplaces focus on sustainability, growth, and resilience.

Fads in Family Office Realty Investments

When thinking about patterns in family members workplace property financial investments, it is very important to examine recent market data for informed decision-making. By maintaining https://bamcapital.tumblr.com/bam-capital-reviews on market changes, you can much better position your investments for success. Family offices are progressively diversifying their property profiles to mitigate dangers and maximize arising opportunities.

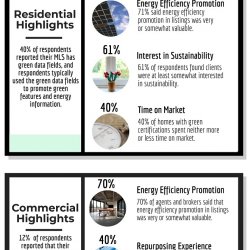

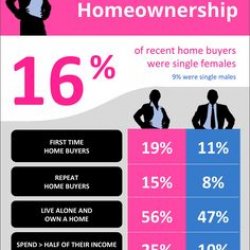

One noticeable fad is the expanding interest in lasting and socially responsible property financial investments. Lots of household offices are straightening their worths with their investment approaches, going with residential or commercial properties that focus on environmental conservation and social influence. This not just helps in developing a positive adjustment yet also enhances the long-lasting value of the investment.

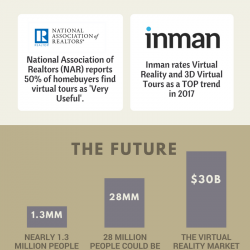

Furthermore, technology is playing a substantial role fit household office real estate financial investments. From making use of information analytics for residential or commercial property assessment to integrating wise building innovations for performance, staying abreast of technical innovations can give you an one-upmanship on the market. By leveraging these trends successfully, you can navigate the vibrant landscape of family members workplace real estate financial investments with self-confidence.

Approaches for Sustainable Growth

To achieve lasting growth in family workplace property investments, consider aligning your long-lasting monetary goals with environmentally conscious and socially liable financial investment approaches. Investing in homes that focus on energy efficiency, sustainable materials, and eco-friendly structure qualifications can’t only benefit the environment however additionally result in cost savings and increased home worth gradually.

In addition, including social responsibility right into your investment strategy by sustaining neighborhood development jobs, economical real estate initiatives, or sustainable urban planning can boost your general effect and track record in the realty market.

Diversifying your realty profile throughout different industries such as property, industrial, and commercial residential or commercial properties can assist minimize risks and maximize returns. Welcoming best reit funds for Highly Sophisticated Investors and innovation in residential or commercial property administration, such as applying wise building options or utilizing data analytics for decision-making, can streamline operations and boost performance.

Furthermore, staying educated about market fads, policies, and arising possibilities in sustainable property can position you for long-lasting success and development in the ever-evolving property landscape.

Overcoming Difficulties in Realty

Navigating obstacles in real estate calls for positive analytical and calculated decision-making to make sure continued success and growth in your investment endeavors. In this vibrant industry, obstacles are inevitable, yet with the best strategy, you can conquer them effectively.

Here are three vital techniques to help you deal with the difficulties that may come your method:

1. ** Market Volatility: ** Stay notified about market trends, financial indications, and geopolitical occasions that might affect property values. Being proactive and adaptable in reaction to market changes will help you make educated decisions and alleviate risks.

2. ** Regulatory Changes: ** Keep up with governing updates and changes in legislations that control realty purchases. Involve lawful counsel to ensure conformity and browse any kind of legal difficulties successfully.

3. ** Risk Monitoring: ** Apply a robust danger administration technique that includes diversification, complete due persistance, and contingency preparation. By determining and alleviating prospective dangers early on, you can secure your financial investments and minimize potential losses.

Conclusion

As you navigate the world of household workplace real estate financial investments, bear in mind to stay informed on trends, implement sustainable development techniques, and take on challenges head-on.

By attaching intention and objective, you can create a successful portfolio that aligns with your objectives and worths.

Remain aggressive, remain concentrated, and remain devoted to constructing a strong foundation for your future wide range.

Maintain knowing, maintain expanding, and keep investing with intention.